Why AI Changes the Game in Financial Analysis

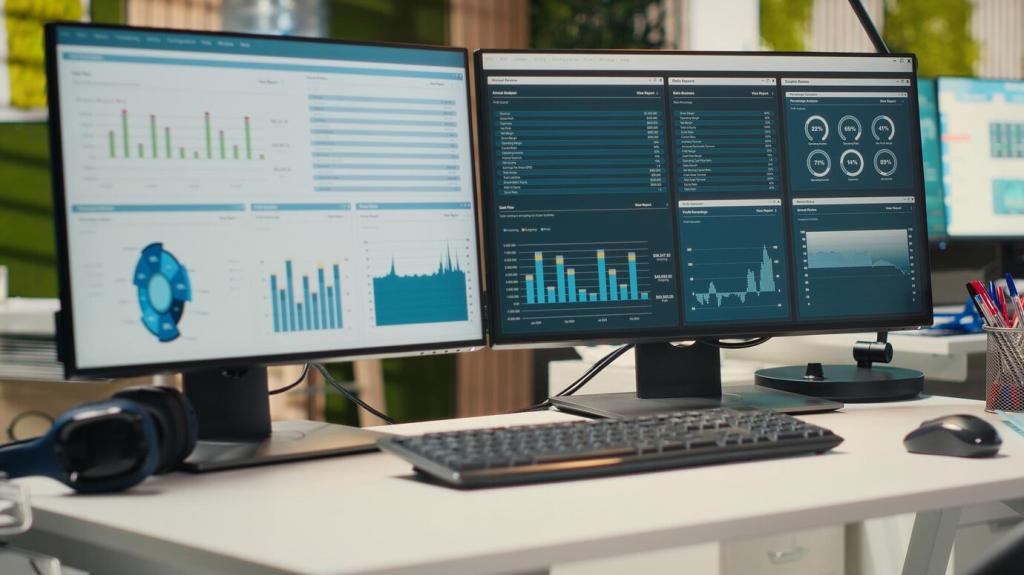

AI systems clean, normalize, and reconcile data across ERPs, banks, and market feeds, shrinking manual effort. Feature engineering and anomaly detection surface consistent signals, giving analysts trustworthy baselines for every critical financial decision.

Why AI Changes the Game in Financial Analysis

Machine learning identifies subtle seasonality, cross-asset relationships, and regime shifts that easily hide in spreadsheets. Models highlight drivers behind variance and reveal early indicators, helping teams act before issues ripple through results.

Why AI Changes the Game in Financial Analysis

NLP layers translate complex metrics into plain-language summaries, adding context, alerts, and suggested next steps. Executives get clarity without hunting through tabs, while analysts keep the ability to drill into every underlying assumption.

Why AI Changes the Game in Financial Analysis

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.