Chosen theme: Automated Solutions for Financial Reporting. Step into a world where reconciliations align themselves, variance drivers surface instantly, and your close is predictable, controlled, and calm. Join our readers, subscribe for fresh insights, and share your own automation wins or worries.

Data Integration and Quality by Design

Unifying ERP, CRM, and Bank Feeds

Automated connectors ingest journals, subledger details, pipeline data, and statements on a defined cadence. Consistent dimensions, exchange rates, and calendars ensure apples‑to‑apples comparisons, so your P&L, cash flow, and balance sheet remain aligned across every entity and region.

Master Data Governance in Finance

A small rules engine prevents rogue cost centers and duplicate accounts before they pollute reports. Finance‑owned reference data, with approvals and versioning, keeps mappings stable, while change logs make audits of chart‑of‑accounts updates swift and transparent.

An Anecdote: The Mysterious Penny

One controller battled a one‑cent discrepancy each quarter. Automated matching finally exposed a rounding rule in a legacy feed. The fix took minutes; the team reclaimed hours, and the tiny penny stopped stealing outsized attention forever.

Segregated duties, maker‑checker approvals, and tamper‑evident logs are enforced by workflow. Configurable thresholds trigger reviews on material changes, while standardized reconciliations provide consistent support, meeting SOX objectives without relying on uncontrolled, one‑off manual checks.

Controls, Compliance, and Audit Readiness

Upskilling the Finance Team

Short workshops on data literacy, workflow ownership, and basic automation tools transform skeptics into champions. When analysts can adjust a rule or build a small reconciliation, momentum grows. Tell us which skills your team wants to master next.

Citizen Automation—Safely Done

Guardrails matter. A governed sandbox lets finance prototype automations, while IT enforces standards, security, and backups. This partnership accelerates value and prevents shadow systems that create tomorrow’s headaches from today’s well‑intentioned quick fixes.

Event‑Driven Finance Data Pipelines

Instead of nightly batches, event triggers move data when it changes. Reconciliations, currency translation, and allocations run incrementally. Stakeholders see near real‑time views, and exceptions surface early, shrinking end‑of‑month surprises into manageable daily tasks.

Choosing Between RPA, iPaaS, and Native Connectors

Use RPA for UI‑only systems, iPaaS for orchestration and transformations, and native APIs wherever possible for resilience. A small decision matrix prevents over‑engineering, reduces maintenance, and keeps the financial reporting flow clean and understandable.

Reference Architecture You Can Explain

A simple diagram—sources, pipeline, governance, workflow, analytics—keeps everyone aligned. When engineers, controllers, and auditors can describe the same picture, projects move faster. Comment if you want a printable checklist to socialize with your stakeholders.

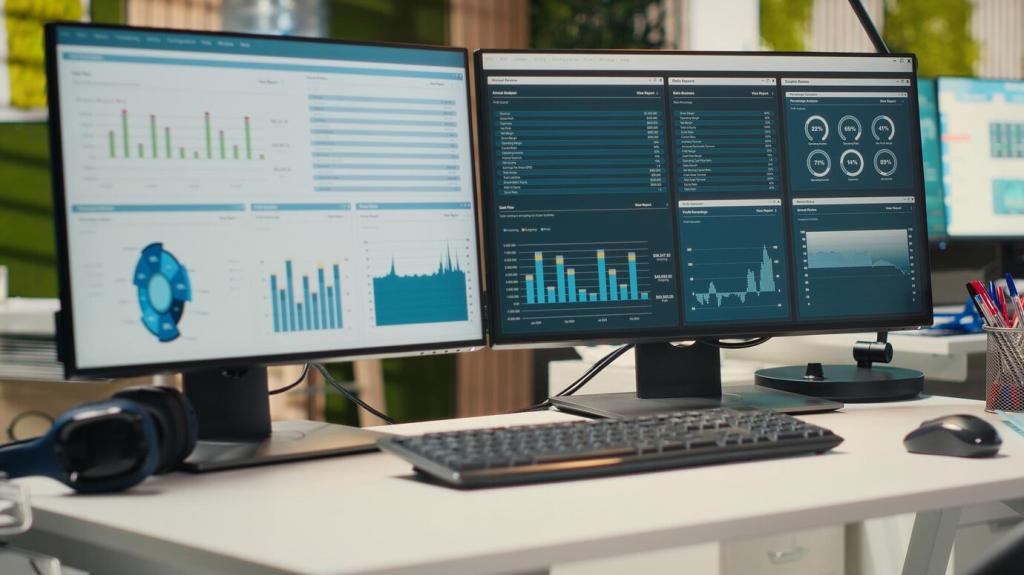

Days to close, auto‑match rates, manual journal counts, and audit request turnaround times tell a honest story. Publish trends in a shared dashboard, and invite the business to challenge goals so improvements stick beyond the pilot phase.

Measuring Success and Iterating

A light but consistent cadence—design reviews, release notes, and post‑mortems—keeps quality high. Finance owns outcomes; IT owns platforms; both share standards. Subscribers, tell us which governance practices have made your automations resilient and trusted.